What is a DAF?

A Donor-Advised Fund (we call it a Giving Fund) is a simple charitable account. You give to your fund, receive an immediate tax receipt, and then recommend grants to any Canadian charity whenever you’re ready.

Who is a DAF for?

DAFs are for anyone who wants to give with more ease. Whether you’re a family supporting several causes, a professional looking for tax-smart giving, or someone planning a legacy, a Giving Fund keeps your generosity organized in one place.

Why use a DAF?

A DAF makes giving simple, flexible, and impactful:

-

One account, one receipt, any charity.

-

Donate cash, securities, or other assets.

-

Give now or later, while staying organized and intentional.

Giving Made Simple

Once you have signed up for a GiveWise Giving Fund, giving is as easy as 1, 2, 3!

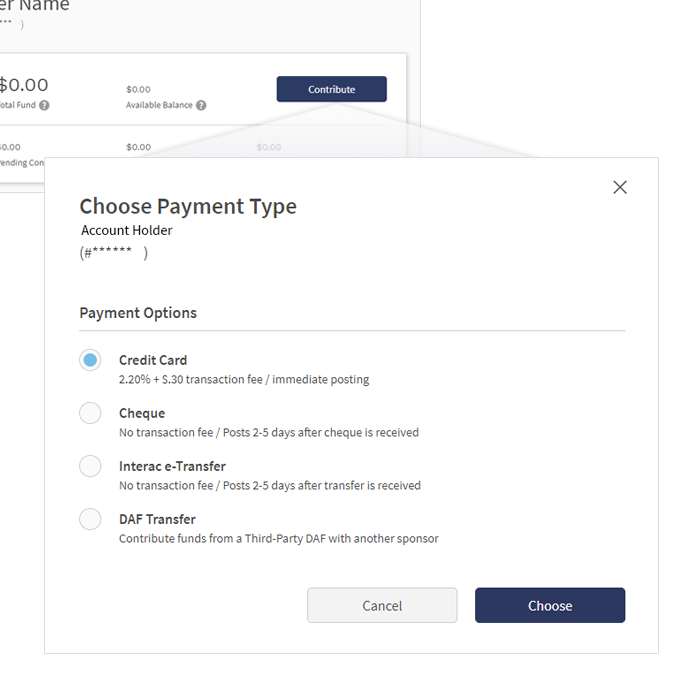

Step 1: Add To Your Giving Fund

You can add funds to your Giving Fund online by using credit card or bank transfer. You can also send a cheque, wire transfer, or securities to GiveWise for processing. You can also schedule recurring contributions!

Your contribution is an irrevocable donation to GiveWise Foundation Canada, and once accepted, you will receive a tax receipt.

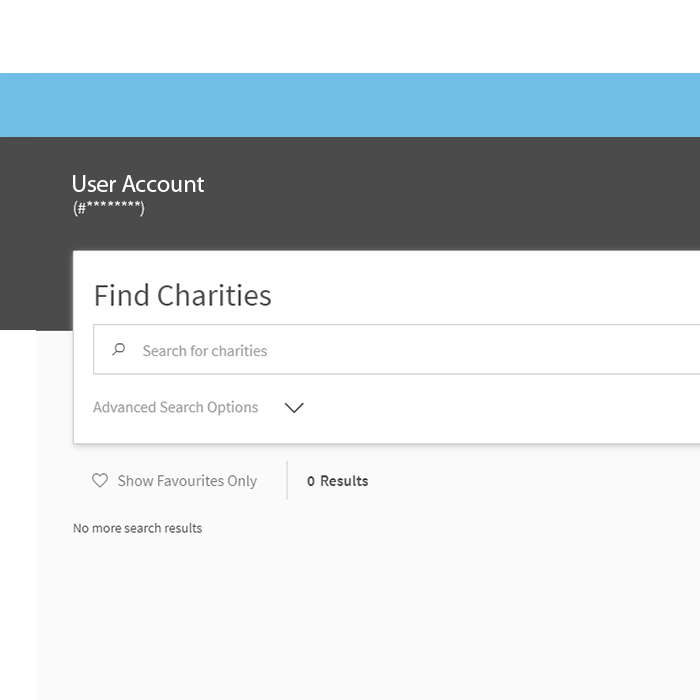

Step 2: Support the causes you love

Time to have fun! Find what inspires you and give. Once you have contributed to your Giving Fund, you can choose to gift funds right away, or wait until later when you have more time to find the right fit. Gift funds to any registered Canadian charity: you choose when, where and whether it's a one-time or a recurring gift from your GiveWise Giving Fund.

Have kids? Make it a family affair

Take part together as a family! Getting children involved in choosing where the funds go is a fantastic way for them to take ownership and experience the power of giving. Your children can create their own Giving Funds and you can use our Shared Funds feature to transfer to them, allowing you to experience the impact of your giving together.

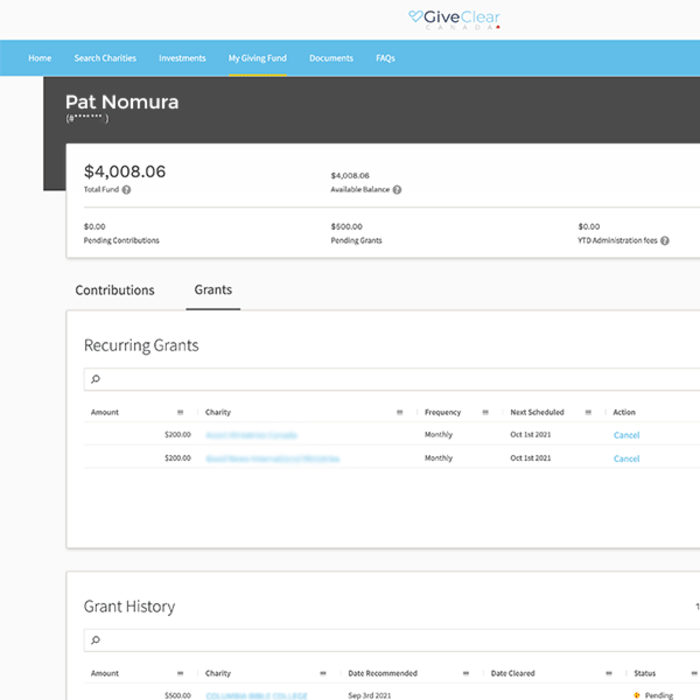

Step 3: See your impact at a glance

Track all of your contributions and gifts in one place through your GiveWise dashboard. You can see all your historical giving data which helps you meet your giving goals

How does a Donor Advised Fund (DAF) work?

A GiveWise Giving Fund

Donor

Donate:

Cash / Securities / Complex Assets

Receive: Tax Receipt

Designate:

To any registered Canadian charity

Local, national & global impact

Charities

A Giving Fund can consist of:

Financial Advisor

Talk to your Advisor to maximize your giving & tax saving benefits

Investment Account

Maximize your giving with an investment account. Talk to your financial advisor to create a plan that's right for you

Do-It

Yourself

Anyone can open an account & start donating to their favourite charities today!

Giving Wallet

Hold your funds until you are ready to designate the funds to the charity of your choice. Set up recurring grants & contributions as well.

DAF FAQs

GiveWise Foundation Canada is a registered charity with Canada Revenue Agency, Business Number 701032526 RR0001. GiveWise acts as a charitable grant making foundation and establishes Donor Advised Funds (Giving Funds).

While GiveWise exists to help more people give more money to more charities, we are a Canadian Registered Charity ourselves. So what does this mean? It means that we rely on the generosity of people like you, our donors! Some amazing people were generous enough to invest the seed money to get GiveWise started through a significant donation, but we need to keep moving forward, and that requires resources.

GiveWise charges monthly Giving Fund Administration Fees on funds with balances over $25,000, however, these fees do not cover all of costs, and so we humbly ask that you would consider allocating a percentage of your overall GiveWise Giving Fund to operations.

If our donors gave an average of 3% of the value of their contributions, this would supplement GiveWise's operations expenses and help us to keep spreading the generosity to more and more Canadians.

Will you invest in GiveWise Foundation Canada? If so, please do so directly through the Search Charities page.

There are no fees for cheque, e-transfer, or bank transfer contributions. Fees are withheld from credit card contributions and some other contribution methods (like securities and wire transfers) are subject to Administration Recovery Fees. Please refer to the Fees for Contributions Section in our Fees Schedule for more details

A Giving Fund is a simple, tax-efficient vehicle for all of your charitable giving. It allows you to do all of your giving in one place, with one tax receipt, and you can give to any Canadian Registered Charity.

Log in to your Giving Fund, go to the “Tax Receipts” tab in the navigation bar, and download your tax receipts by year.

Contributions can be made using: credit cards, eTransfers, bank transfers, cheques, DAF transfers, cryptocurrency and stocks/securities.

For the latest updates & news from GiveWise sign-up to our e-newsletter.