Generosity in Motion: What 2025 Taught Us About How Canadians Give

2025 proved something important: generosity in Canada isn’t slowing down — it’s getting smarter, more intentional, and more impactful.

Across the country, donors continued to show up for the causes they care about. What shifted wasn’t whether people gave, but how they chose to give. And behind the scenes, GiveWise was proud to support that shift — helping generosity move with clarity, confidence, and momentum.

As we reflect on the year, we didn’t just look at totals. We looked at patterns. And what those patterns reveal matters for donors, charities, and advisors alike.

👉 Watch our 2025 Year in Review video to see generosity in motion.

2025 at a Glance

Here are a few highlights from 2025 that showcase the power of our community:

7000 Gifts

to Canadian charities

$ 19.7 Million

in donations

47 %

disbursement rate

*far exceeding the Canadian DAF average of 12-17%.

These numbers tell an encouraging story. But they don’t tell the whole story.

To understand what really changed in 2025, we need to look more closely at how generosity showed up.

A closer look at how Canadians gave

When we reviewed GiveWise’s 2025 data, one pattern stood out immediately.

Nearly three-quarters of receipted contribution volume came from securities and other non-cash assets — not from credit cards.

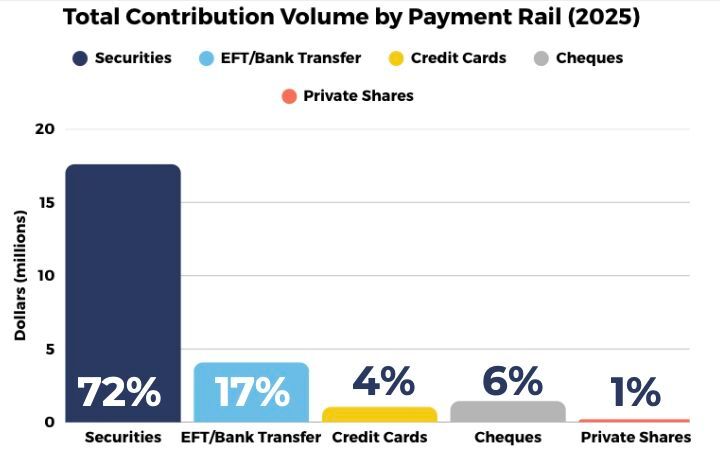

In 2025:

- 72% of receipted contributions came from securities

- 17% came from EFT or bank transfers

- Just 4% came from credit cards

- The remainder came from cheques and other methods

This isn’t an edge case. It’s the dominant way generosity is showing up on our platform.

The tension we keep seeing

At the same time, we’ve been paying close attention to how charities talk about giving.

Across charity websites — large and small, local and national — the primary message to donors is often the same:

Donate by credit card.

Our Executive Director, Tammy Kyte, recently reflected on this growing disconnect: while most receipted giving we see flows through securities and investments, most charities still communicate only one way to give.

The data tells a different story.

When donors are educated and offered simple options, many want to give from their wealth, not just their wallet.

Why securities giving changes the picture

For many donors, generosity isn’t sitting in cash. It’s held in assets they’ve built over time — stocks, mutual funds, ETFs, or private shares.

A simple example helps illustrate why this matters.

A donor purchases shares for $1,000. Years later, those shares are worth $5,000. If they sell the shares and donate the cash, a portion of that value may be lost to tax. If they donate the shares directly, they can often give the full $5,000 to charity.

When donors understand this difference, gifts tend to be larger, more intentional, and more impactful.

Giving securities doesn’t need to be complicated.

See how donating securities through GiveWise works →

------------------------------------------------------------------------------------

Where donor-advised funds quietly help

This is where donor-advised funds (DAFs) often change the experience.

A DAF allows a donor to contribute once, receive their tax receipt, and then support multiple charities over time. That flexibility matters — especially when giving securities, which typically requires more effort than a one-click credit card donation.

Rather than repeating that process for every charity they support, donors can give once and then distribute grants thoughtfully throughout the year.

From a charity’s perspective, this often simplifies things.

- They don’t need to issue tax receipts.

- They don’t need to process securities.

- Charities don’t need a brokerage account.

They simply receive gifts — turned directly into cash — while GiveWise handles the complexity behind the scenes.

Curious how GiveWise works behind the scenes?

Learn how Giving Funds help donors give more intentionally →

------------------------------------------------------------------------------------

What this means heading into 2026

If there’s one mindset shift worth carrying forward, it’s this:

Donors’ generosity is often held in their wealth, not just their wallet.

Making this visible doesn’t require charities to become financial experts. It simply requires opening the door — offering clear, simple ways for donors to give in the ways that allow them to be most generous.

As we look ahead to 2026, it may be worth asking:

Are we making it easy for donors to give in the ways that reflect how they actually hold their wealth?

Because when generosity is supported with clarity and trust, it tends to move further — and faster — than we expect.

Thank you for a generous year

To every donor, charity partner, advisor, and supporter — thank you.

2025 was a year of generosity in motion.

And we’re grateful to be building what comes next, together.