Why Charities Choose GiveWise:

Zero Fees

100% of the gift goes to your cause.

Effortless Receipting

we handle all tax receipts

Weekly Payments

full transparency

Free Donor Advised Funds (DAFs)

donors can manage all donations in one place

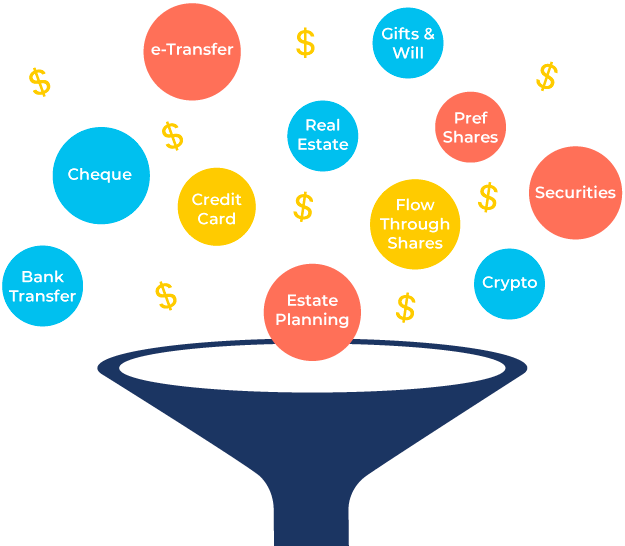

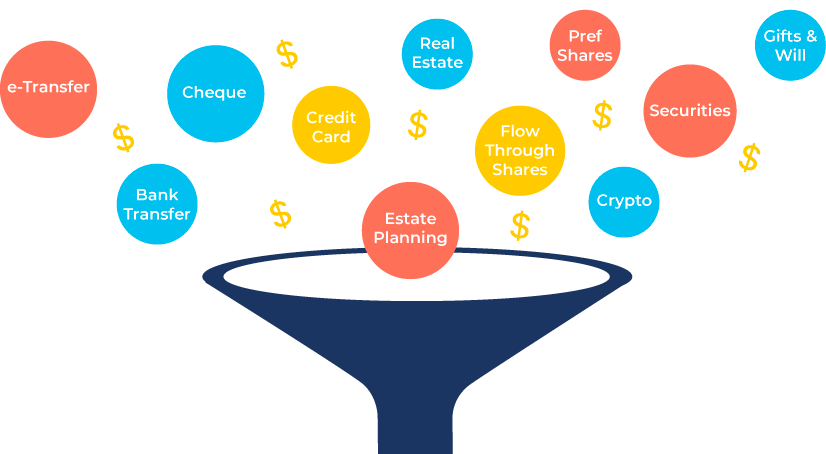

We Handle Other Ways to Give

securities, shares and more

Let’s Grow Generosity Together

Whether you want one event or a full strategy, GiveWise gives you tools to simplify giving and grow support.

Tools that work together to grow giving

GiveGenius and Generosity Exchange work together to help you spark generosity and accept every gift — without adding new systems, staff, or stress.

GiveGenius:

Seamless Online Giving

A flexible donation experience for your site that supports cards, crypto, e-transfers, DAFs, and more.

Features:

- Embed or link from any page

- Works with your CRM

- Easy setup - copy and paste

More than a donation form — it builds donor trust and makes every gift easier.

Generosity Exchange:

Donor Education

Inspire and retain donors through co-branded events, videos, and journeys.

Features:

-

Live or recorded experiences

-

DAFs, securities and estate giving

-

Donor-ready, low-lift for your team

Most donors want to give more — they just need to know how. We help you show them.

Unlock bigger gifts — without the complexity.

Your mission. Your donors. Our support.

GenerosityWorks

Empowering your tribe to spread the word and fundraise for your organization.

GiveWise handles donations, tax receipts, and direct deposits — all with timely reporting. We’re so grateful for this partnership. Highly recommend!

Real Results, Real Generosity

Over 800 Canadian charities have partnered with GiveWise to process more than $68 million in donations — and counting.

Our seamless donation experience, donor-advised funds, and tax-smart giving tools don’t just make generosity easier — they help build long-term trust and support.

Impact Highlights:

$45M+

sent to Charities by GiveWise donors (with 0% transaction fees)

Weekly donations

processed for local, national, and global causes

Thousands of donors

managing their giving through personalized Giving Funds

Let's Grow Generosity Together

Whether you want one event or a full strategy, GiveWise gives you tools to simplify giving and grow support.

No pressure — just a quick conversation to explore if GiveWise is right for you.

Supporting Organizations Across Canada

For local, national and global impact

$ 30 M +

donor-designated gifts out to charities

0 %

transaction fees charged to charities.

771 +

charities have received donor-designated gifts.

$ 68 M +

total contributions for charitable giving.

Unlock smarter giving for your charity. Get tools, ideas, and real-world tips in our Charity e-newsletter.